Cotton's Guide to Camera Shopping, 2016

Page 4 of 6. Version 1.0, ©2016 by Dale Cotton, all rights reserved.

Interchangeable Lens Camera Manufacturer Report

The photographic image has become a second vehicle for personal communication, providing a visual language that's now nearly equal to verbal language in ubiquity. Even in developing countries people use the web to share images on a massive scale.

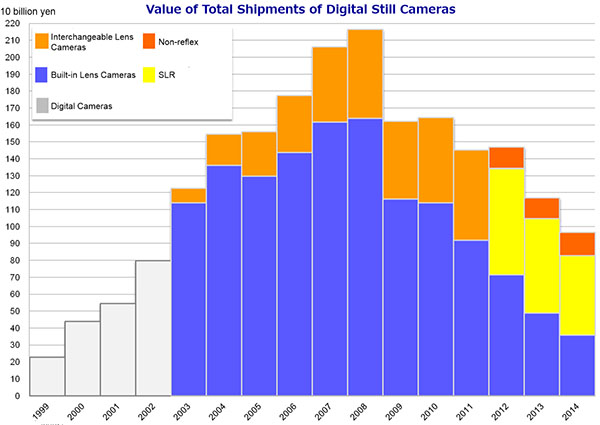

Despite this enormous increase in photography, the non-smartphone photography industry has been contracting in both sales volume and dollars for several years. This has put enormous pressure on manufacturers in this sector, which no company has escaped. Growth was rapid in the 2000s as the world converted from film to digital. But not only has the first-world market saturated, also the rise of camera-equipped smartphones provided an image-creation solution good enough for the majority of potential customers.

A dedicated digital camera has key advantages over smartphone cameras, including zooming, low-light handling, and rapid response time during image capture. Smartphones trump all this simply by being always at hand while seamlessly combining image capture with image sharing.

Canon

Canon is still world leader in (non-smartphone) camera and lens sales. It also has other sources of revenue in its product suite. Canon retained its market share during the transition from film to digital by aggressively leveraging new digital technologies to offer both budget consumer plus relatively low-priced enthusiast products. By keeping its interchangeable-lens cameras compatible with its film camera lenses, Canon not only retained much of its previous customer base, it also retained its position as having the largest selection of lenses for its cameras. Secondly, in order to outperform its rivals, Canon made a huge investment to build its own image sensor factory. However, Canon's strategy, highly effective in the short to medium term, proved to contain two key flaws:

- Its legacy lens line-up is highly specialized toward Canon's SLR camera tech. Even as much of the industry is moving to mirrorless, Canon has been forced to protect its lens line-up advantage by introducing only a single, highly crippled mirrorless design (EOS M) with a few dedicated new lenses.

- The sensor factory that initially produced sensors with class-leading image quality, now seriously lags behind the competition. This forces Canon to either invest in an expensive upgrade to the plant (plus likely an equally expensive licensing of sensor-related patents), or to purchase sensors elsewhere. Apparently both would be cripplingly expensive, as Canon has consistently chosen to do neither.

Health: Canon remains the camera industry market share leader. Despite falling camera revenues, it is nowhere near danger. Canon still specializes in SLR (EOS) and point&shoots (Cybershot).

Strengths: best all-around shooting experience. Excellent range of relatively affordable lenses. Excellent AF for action. Excellent service and support.

Weaknesses: sensors are (visually) noisier, so some limitations in dynamic range and high ISO reach exist at the extremes. No serious mirrorless options. SLRs tend to be large and hefty.

Canon 7D Mark II + Sigma 120-300mm. © Michael Murphy, 2014. All rights reserved.

Notable options: the EOS 7D mark II is a large APS-C body with superb handling, and excellent IQ despite not class-leading dynamic range. The EOS SL1 is perhaps the world's smallest dSLR but very well respected all the same (An SL2 is rumoured to replace it soon.)

Nikon

Nikon was quite healthy during the film era, despite being second in revenue to Canon and despite not having a significant alternate source of revenue. It weathered the transition to digital by making some significant management changes in the mid-2000s that allowed it to more aggressively adapt to the rapid tech changes inherent in digital. However, now that the digital photography industry is contractng, Nikon is under considerably more stress than Canon, due to its lack of alternate revenue plus its decision to protect its advantage of having an extensive lens line-up. Nikon has ventured a bit more deeply into the realm of mirrorless than Canon. It has multiple camera bodies plus a few lenses in its mirrorless product portfolio. But no product in this portfolio is strong enough to compete against the competition.

Health: To cope with falling revenues Nikon has been in cost-cutting mode for several years. Unless it can invent a game-changing new strategy, it looks to be very near crunch time, possibly via a serious downsizing exercise. Nikon's revenues presently derive from a mix of consumer SLRs, such as the D3300 and D5500, plus higher-end SLRs, such as the D7200 and D750. Its mirrorless line (Nikon 1) may either be just breaking even or may be operating at a loss.

Strengths: best image quality. Most Nikon models use a Sony sensor and manage to eke out a bit more image quality than Sony does. Excellent but pricey lens line. Good-to-excellent AF for action.

Weaknesses: often limited buffering and low-light focusing. Many users experience interface usability issues. No competitive mirrorless option. Numerous reports of service and support problems, at least in North America.

D750 + Sigma 150-600mm. © Michael Murphy, 2015. All rights reserved.

Notable options: D750 is Nikon's best all-around camera, 24 MP full frame. D7200 is APS-C 24 MP, somewhat smaller and less expensive. Nikon's two recent announcements – the APS-C D500 and the top-of-line D5 – are specialized as expensive rugged workhorses.

Sony

Sony entered the interchangeable lens camera market by purchasing and absorbing the former Minolta camera company in 2006. More recently, its huge corporate wealth failed to buffer pressures in most of its product areas, leading to huge losses. Significant restructuring saw Sony back in the black in 2015. Its imaging division, however, has been holding its own due to aggressive and rapid technical advancements. In an apparently strange move Sony is divesting itself of its sensor fabrication division, despite it always being a profit centre. Presumably, this results in Sony's photography teams having to compete with its own external competitors for sensor development and production time.

Strengths: best sensors, best miniaturization tech, and greatest focus on innovation. The superb lens company, Zeiss, produces pricey but excellent lenses for Sony cameras.

Weaknesses: Sony is forever starting new product lines then abrubtly abandoning them, so continually floods the market with a bewildering array of fascinating but flawed products. As a very large company, Sony has virtually no interest in customer concerns and tends to have a poor reputation for customer support services. The current contraction in the photography market has forced Sony's camera division to at least start mouthing platitudes of customer focus. There are even occasional signs of changes happening due to customer demand, but only when it doesn't impact Sony's bottom line. Because Sony's camera division always has access to the latest generation of Sony's sensor division's best-of-class sensors, one would think Sony cameras would have the best image quality going. In fact, Nikon nearly always manages to get a few percent better image quality from Sony sensors than Sony does itself.

Noteable options: A7R mark II is Sony's ultra-expensive full frame, 42 MP body, which has been generally very well received. Yet the older and original A7 model, is simply the smallest, lightest interchangeable-lens full frame camera avaiable, with excellent image quality at 24 MP and with very nice handling. It's perhaps also the least expensive. The APS-C, 24 MP A6000 has been extremely well received, is due for replacement, and is continually on sale as I write this. (The normal 16-50 kit zoom is highly flawed; the older 18-55 zoom should be purchased instead.)

Pentax

Pentax was a small and successful company during the film era and into the digital era. More recently its long-time head and mentor died, just after selling the company in 2007 to Hoya, which he hoped would be a worthy partner. That failed, the Pentax brand was again sold in 2011, this time to a now also-floundering imaging company, Ricoh. Ricoh's non-photographic portfolio is keeping it afloat, but the photographic side is suffering from the downturn.

Health: An SLR specialist showing little hope of re-inventing itself through mirrorless or anything else. Not on life support but who knows for how long?

Strengths: superb user interface. Excellent line of prime lenses. Good to decent support, at least in Canada.

Weaknesses: Small market share, seemingly in danger of extinction as camera market contracts. No serious mirrorless options. No full frame SLR. Zoom lens line-up is spotty.

Notable options: 645Z is the only larger-than-full-frame or medium format camera available in an at all affordable price. Very well respected. All it's current APS-C dSLRs are fine but due for replacement.

Olympus

Despite a huge cooking-the-books scandal a few years ago, Olympus shows every sign of weathering the industry downturn quite well. Olympus is a relatively small player that seems to stay healthy by not punching above its weight. Where Canon, Nikon, and Pentax boxed themselves into an SLR-dependent strategy, Olympus survived both the transition to digital and the transition to mirrorless but boxed itself in by putting nearly all its eggs in the 4/3rds sensor format. This is not necessarily a fatal position. It seriously limits Olympus' ability to capture a greater share of available revenues, but Olympus seems to be thriving at its current revenue size, so doesn't actually need to grow.

Health: relatively clear sailing on Olympus' current course.

Strengths: wide array of lenses with excellent optics. Smallish, versatile camera bodies.

Weaknesses: small sensors (micro 4/3rds) have built-in limitations on resolution (currently 16 megapixels), ISO (6400 is iffy), and dynamic range. No SLR options. Relatively small market share but not showing signs of flat-lining.

Notable options: EM5, EM5 mark II, EM10 are all similar in size and features with award-winning capabilities. EM1 is even better but is more expensive. All are 16 MP. Announced in January: Pen-F digital with 20 MP sensor. Very little change in capabilities, the Pen-F is more about re-packaging in a truly retro design.

Panasonic

Panasonic is a diversified mega-corp that has nevertheless been bleeding red ink for several years. I don't have a feel whether its in or out of the danger zone. Its photography division has been producing very respected products, particularly as a company that produces cameras that are reputed as being good for still photography but excellent for videography. Panasonic and Olympus form the Micro Four Thirds partnership, so their lenses are interoperable, which provides a significant benefit to both companies in breadth of lens choices available to their customers.

Health: Like Olympus, Panasonic is focused on the 4/3rds format, but unlike Olympus, Panasonic gives the impression of having sufficient resources to break loose from that straightjacket at any time.

Much the same story as Olympus. Panasonic's own sensors have been noisier in the past than the best of the competition, but that seems to have changed. Panasonic excels at producing cameras with excellent video capabilities. G7 is an excellent and versatile, fairly low priced, 16 MP camera.

Fujifilm

Fujifilm, like Kodak, had huge corporate resources during the film era. Even then it produced its own niche camera line that was respected but never high-volume. Fuji seems to have weathered the transition to digital in one piece. It surprised everyone a few years back by launching its own line of enthusiast-level digital cameras and lenses. These have a relatively small but vibrant customer base, despite the fact that Fuji boxed itself into the use of an eccentric sensor technology together with a single sensor format (APS-C).

Health: Fuji seems to be thriving much like Olympus by not trying to do more than its capitalization permits.

Strengths: small player but very attentive to customer feedback. Provides extensive firmware upgrades that keep older models from going obsolete. Excellent lens quality.

Weaknesses: Fuji uses a proprietary sensor design with some serious limitations that show under certain conditions, much denied by its fan base. Produces only APS-C mirrorless cameras.

Notable options: I can't honestly recommend any of the Fuji bodies due to image quality issues with their proprietary sensor, although this is greatly dependent on your choice of subject matter. Their XA1 is well regarded but doesn't have a viewfinder.

Samsung

Samsung is a huge mega-corp that as a whole seems to be in excellent shape. It's camera division, despite having recently produced some excellent and class-leading cameras, is showing signs of great stress. It has halted sales in at least two European markets.

Health: situation critical.